Have you ever wondered how the government can influence the price of goods and services? One way is through the implementation of a price floor. This seemingly straightforward economic tool can have far-reaching consequences, creating both opportunities and challenges. Here, we delve into the world of price floors, exploring their impact on markets, consumers, and producers.

Image: wizedu.com

Imagine a world where the price of milk plummeted, leaving dairy farmers struggling to make ends meet. This is a scenario where a price floor might come into play. A price floor, essentially a minimum price set by the government, functions as a safety net for producers, preventing prices from falling too low. While it might seem like a simple solution, the implications of a price floor can be quite complex, often leading to unintended consequences, particularly when it is set above the equilibrium price.

Understanding the Basics: Supply, Demand, and Equilibrium

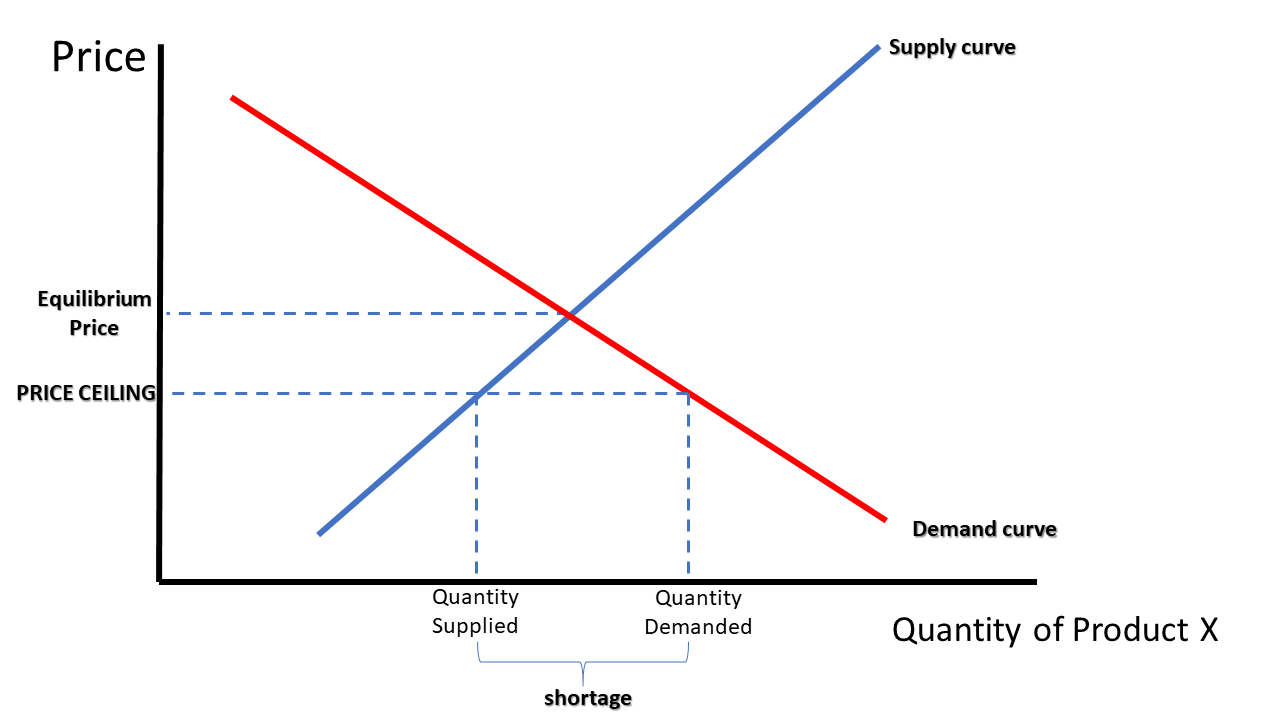

Before delving into the specifics of price floors, let’s lay the groundwork by revisiting the fundamentals of supply and demand. In a free market, the price of a good or service is determined by the interaction of these two forces. The supply curve, illustrating the quantity producers are willing to offer at different prices, slopes upwards, reflecting the fact that producers are more likely to supply more goods when prices are higher. The demand curve, on the other hand, slopes downwards, indicating that consumers tend to demand more goods when prices are lower.

The equilibrium point, where these two curves intersect, represents the market-clearing price and quantity. At this point, the quantity supplied perfectly matches the quantity demanded, leading to a stable market without surplus or shortage.

The Impact of a Price Floor: Above Equilibrium

Now, let’s consider the scenario where a price floor is set above the equilibrium price. This creates a situation where the minimum price set by the government is higher than the price that would naturally be established by the market forces of supply and demand. In such a case, the price floor becomes a binding constraint, influencing the market outcome.

The Effects on Supply and Demand

- Excess Supply: When the price floor is above the equilibrium price, producers are willing to supply more goods than consumers are willing to purchase at that higher price. This creates a surplus, or an excess supply, in the market.

- Reduced Demand: The higher price imposed by the price floor discourages consumers from purchasing as much of the good. The demand for the good decreases, contributing to the surplus.

- Market Distortion: The price floor disrupts the natural balance of the market, preventing the forces of supply and demand from determining the price. The equilibrium point, often a reflection of the true value and scarcity of the good, is superseded by the government-imposed minimum price.

Image: www.gpb.org

Real-World Consequences: Unintended Effects

While price floors are often implemented with the intention of supporting producers and ensuring their livelihood, they can have unintended consequences for the overall market and consumers.

- Increased Costs: The higher prices mandated by the price floor lead to increased costs for consumers, who may have to pay more for essential goods and services, such as minimum wage laws which often increase costs for labor-intensive businesses.

- Black Markets: The creation of a surplus encourages black markets, where goods are bought and sold at prices lower than the price floor, as these goods are often sold in the shadows and out of public view.

- Reduced Efficiency: The surplus created by the price floor can lead to wasted resources. Producers may be forced to produce more goods than are actually demanded, resulting in unsold inventory and financial losses.

Examples of Price Floors in Action

- Minimum Wage Laws: Often considered the most prominent example of a price floor, minimum wage laws set a minimum price that employers must pay their workers. These laws aim to ensure a decent standard of living for workers, but they can also lead to job losses, particularly in sectors where wages are already close to the minimum wage.

- Agricultural Support Programs: The government often sets price floors for agricultural commodities in an attempt to protect farmers from price volatility. The government may purchase surplus crops to stabilize prices, but this can lead to inefficiencies and taxpayer costs.

- Rent Control: Rent control laws, which limit the amount landlords can charge for rent, are another form of price floor. This policy can help low-income renters afford housing, but it can also discourage landlords from investing in their properties and lead to a shortage of rental units.

The Pros and Cons of Price Floors

While price floors can provide a safety net for producers, they are not without their drawbacks. Here is a summary of the potential benefits and drawbacks:

Pros:

- Support for Producers: Price floors can help ensure that producers receive a fair price for their goods, particularly during periods of low demand.

- Stable Income: By setting a minimum price, price floors can provide producers with a more stable income stream.

- Reduced Poverty: Minimum wage laws and other price floors can help to raise the incomes of low-income individuals and families and reduce poverty.

Cons:

- Surplus and Waste: Price floors can lead to surpluses, as producers are encouraged to produce more than what is demanded. This can lead to wasted resources and a drain on the economy.

- Higher Prices for Consumers: Consumers often face higher prices for goods and services when a price floor is in place, as the minimum price must be passed on to consumers.

- Black Markets: Price floors can encourage black markets, where goods are sold at prices below the minimum price, often outside the regulatory framework of the government.

- Reduced Efficiency: By distorting the market, price floors can lead to reduced efficiency and innovation, as producers are not incentivised to compete on price and quality.

A Price Floor Support Price Set Above Equilibrium

Conclusion

Price floors, while seemingly simple in concept, have far-reaching consequences for markets, consumers, and producers. While they can provide a safety net for certain sectors, they can also lead to unintended consequences, such as higher prices, surpluses, and black markets. Understanding the complexities of price floors is crucial for policymakers and anyone interested in the economic dynamics of markets.

By carefully considering the potential costs and benefits, informed decisions can be made regarding the implementation of price floors, minimizing their negative impacts and maximizing their potential for promoting fairness and stability in the marketplace.

However, it’s important to note that these policies are complex and require careful consideration of the specific circumstances of each market. It’s also essential to consider alternative solutions to address market failures and safeguard producer interests without resorting to price floors.

Ultimately, the decision to implement a price floor should be made with a thorough understanding of its potential consequences and the commitment to mitigating those undesired outcomes.