The stock market can be a rollercoaster ride, with prices fluctuating wildly at times. For investors seeking to navigate this volatility, two popular tools are the VIX index and leveraged ETFs like VXX. But what exactly are these instruments, and how do they differ? This article will demystify the VIX and VXX, explaining their mechanics and how they can be used in your portfolio.

Image: www.youtube.com

Imagine you’re a seasoned investor, but recently the market has been making you feel like a rollercoaster enthusiast without a seatbelt. You’ve heard whispers about the VIX and VXX, and you’re curious how they can help you manage your risk. This article is your guide to understanding these powerful tools and learning how they can be used for both hedging and strategic investment.

What is the VIX Index?

The VIX, often referred to as the “Fear Gauge,” is a popular measure of market volatility. It quantifies the implied volatility of the S&P 500 index options over the next 30 days. Essentially, it gauges investors’ expectations about potential market fluctuations in the short term.

A higher VIX number indicates greater volatility and a heightened sense of uncertainty in the market. Conversely, a lower VIX suggests that the market is relatively calm and investors are less worried about potential price swings.

Understanding VXX: Leveraged ETFs Tracking Volatility

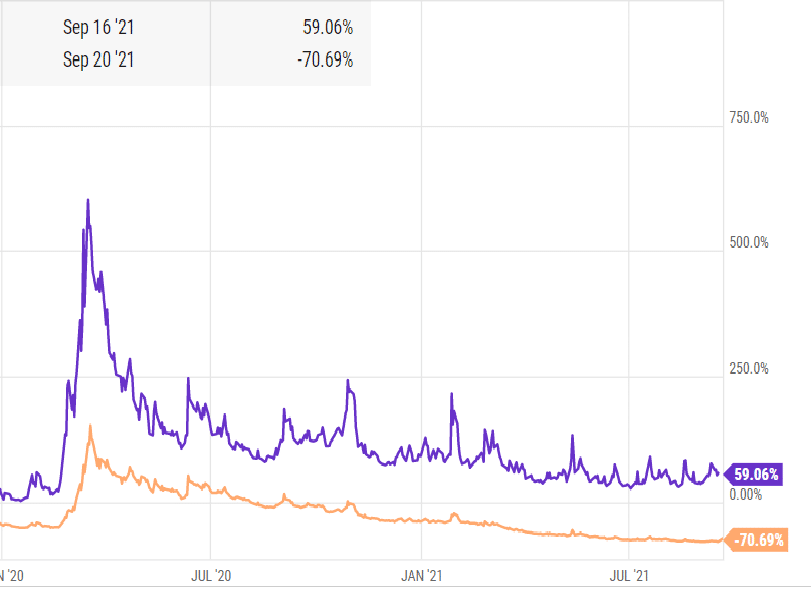

VXX is a leveraged exchange-traded fund (ETF) that seeks to track the performance of the VIX index. However, VXX doesn’t directly track the VIX itself; instead, it aims to deliver a 1x daily return that corresponds to the VIX index.

It’s important to note that VXX is a leveraged product, meaning it amplifies the daily returns (or losses) of its underlying index. This means that while VXX can provide significant gains if the market experiences high volatility, it can also lead to substantial losses if the VIX index declines. This is especially true over longer holding periods due to a phenomenon known as “contango,” which we’ll discuss later.

VIX vs. VXX: What’s the Difference?

The VIX is a measure of market volatility, while VXX is an investment product that seeks to track the VIX index. Think of it like a thermometer (VIX) that measures the temperature (market volatility) and a thermostat (VXX) that aims to control the temperature by reacting to the readings from the thermometer.

While the VIX merely tells you how volatile the market is, VXX gives you a way to directly invest in that volatility. If you believe the market is about to become more volatile, you might consider investing in VXX. However, it’s crucial to understand the risks associated with leveraged ETFs before investing.

Image: www.projectfinance.com

Leveraged ETFs and Contango

VXX’s leveraged structure makes it susceptible to a phenomenon called contango. In contango, futures contracts on the underlying asset (in this case, the VIX) are priced higher than the spot price. This means that the VIX future contracts (which VXX’s holdings are based on) will generally decline in value over time, even if the underlying VIX index itself remains relatively stable.

This contango effect can lead to a gradual erosion of value in VXX, even if the market is not experiencing significant volatility. Over extended holding periods, this can result in considerable losses, even if the VIX is not declining. This is one of the key reasons why VXX is not recommended for long-term investment strategies.

VIX and VXX: Trading Strategies

While VXX can be risky for long-term investments, it can be used strategically for shorter-term trading. Here are a few examples:

Short-term Hedging: If you’re concerned about market volatility, you might consider buying VXX to hedge a portion of your portfolio. This can help to limit potential losses if the market experiences a sudden downturn.

Volatility Trading: Some traders use VXX to capitalize on short-term fluctuations in market volatility. For instance, if you believe the market is about to become more volatile, you might buy VXX. However, it’s crucial to remember that volatility can be unpredictable, and timing your entries and exits is critical for success.

Market Timing: VXX can be a speculative tool for market timers. If you believe the market is about to experience a corrective period, you might buy VXX anticipating an increase in volatility. However, it’s important to remember that market timing is notoriously difficult, and even the most experienced traders can get it wrong.

Tips for Using VIX and VXX

While VIX and VXX can be valuable tools for navigating market volatility, it’s important to use them judiciously. Here are some tips:

- Understand the Risks: Leverage amplifies returns but also magnifies losses. Fully grasp the risks involved with leveraged ETFs before investing.

- Focus on Short-term Trades: VXX is typically used for short-term trading, not long-term investment. Be aware of the contango effect and its impact on long-term holdings.

- Use Proper Risk Management: Employ stop-loss orders and position sizing strategies to manage risk and limit potential losses.

- Consider VIX Alternatives: Products like inverse ETFs (such as XIV, which inversely tracks the VIX) can be considered, though they have their own risks.

- Consult with a Financial Advisor: Seek guidance from a qualified financial professional who understands your risk tolerance and investment objectives before using VIX and VXX.

FAQ About VIX and VXX

How does the VIX influence the stock market?

The VIX is not a direct influence on the stock market itself. Instead, it acts as a reflection of market sentiment and volatility. A rising VIX suggests increasing fear and uncertainty, which can lead some investors to sell stocks, contributing to further volatility. Conversely, a declining VIX indicates a calmer market, potentially encouraging investment.

Is VXX a good long-term investment?

No, VXX is typically not recommended for long-term investing. The contango effect, which causes the futures contracts used to track the VIX to gradually decline in value, generally works against long-term investors in VXX.

Are VIX and VXX suitable for beginners?

VXX and VIX-related products are best suited for experienced investors with a deep understanding of volatility and derivatives. Due to the complexity and risks associated with these instruments, they are generally not recommended for beginners.

How can I track the VIX index?

The VIX index can be tracked on various financial websites, including Yahoo Finance, Google Finance, and Bloomberg. It’s important to consult reliable sources to ensure the information is accurate and up-to-date.

Vix Vs Vxx

https://youtube.com/watch?v=vxX_Z48iRyU

Conclusion

VIX and VXX are powerful tools for navigating market volatility, but they come with risks. VIX, a measure of volatility, can help you understand the risk environment, while VXX provides a way to directly invest in that volatility. It’s crucial to understand these instruments, their mechanics, and the risks associated with them before using them in your portfolio.

Are you interested in learning more about VIX and VXX, or exploring various investment strategies that can help you manage market volatility? Let us know your thoughts in the comments below!