Have you ever wondered what goes on behind the scenes when a lawyer handles your money? The answer lies in the realm of trust account journal entries, a crucial aspect of legal practice that ensures the ethical and transparent management of client funds.

Image: support.actionstep.com

Trust account journal entries, often simply referred to as “trust entries,” are the lifeblood of a lawyer’s financial record-keeping. They meticulously document each transaction involving client funds, providing a clear audit trail that can be scrutinized by both the lawyer and external regulatory bodies. Understanding trust account entries is not just a matter of legal compliance but also a fundamental principle of safeguarding client assets and maintaining the integrity of the legal profession.

The Essence of Trust Accounts

Why Trust Accounts Matter:

Imagine handing over a significant sum of money to a professional for a critical task, only to worry about its safekeeping and proper utilization. That’s precisely where trust accounts come into play. Designed to separate client funds from the lawyer’s operating funds, they offer an essential layer of protection, ensuring that client money remains untainted and cannot be used for personal expenses, ensuring transparency and accountability. Let’s delve into the core aspects of trust account management:

Types of Trust Accounts:

Depending on the jurisdiction and the nature of the legal practice, there are primarily two types of trust accounts:

- General Trust Account (GTA): Used for holding client funds pertaining to various matters, such as retainers, settlements, and disbursements.

- Client Trust Account (CTA): Also known as a “special trust account,” this type is dedicated to specific clients or matters for holding funds related to a particular case.

While some jurisdictions necessitate separate CTAs for each client, others only require a single GTA for managing all client funds.

Image: cpn-legal.com

A Peek into Trust Account Journal Entries

The Fundamentals of Trust Entries:

Trust account journal entries are meticulously documented records of every financial transaction related to client funds. Each entry typically includes essential details such as:

- Date: When the transaction took place.

- Description: A concise and clear explanation of the transaction, specifying the purpose and nature of the funds.

- Debit: An entry representing the funds coming into the trust account. Think of this as an increase in the account balance.

- Credit: An entry representing funds going out of the trust account. Consider this a decrease in the account balance.

- Client and Matter: Identifying the specific client and the case associated with the transaction.

- Reference Number: A unique identifier for the transaction to ensure accuracy and traceability.

Real-World Examples of Trust Entries:

Let’s bring these concepts to life with some practical examples:

Example 1: A client pays a $5,000 retainer for a legal matter. This would be recorded as a debit entry, increasing the client’s account balance by $5,000.

Example 2: The lawyer pays a court filing fee of $200 from the client’s trust account. This would be recorded as a credit entry, reducing the client’s account balance by $200.

Example 3: After a successful settlement, the lawyer receives a $50,000 payment on behalf of the client. This would be recorded as a debit entry, increasing the client’s account balance by $50,000.

Keeping Trust Entries in Order: The Importance of Accuracy

The accuracy and thoroughness of trust entries are paramount, as they serve as the foundation for reliable financial reporting and legal compliance. Trust account records are subject to stringent audits by both regulatory bodies and clients themselves.

Maintaining an accurate record of client funds is crucial not only for safeguarding client assets but also for avoiding potential ethical violations, legal repercussions, and disciplinary actions. The consequences of negligence or manipulation of trust funds can be severe.

Technological Advancements in Trust Account Management

Traditional paper-based record-keeping is rapidly being supplanted by sophisticated software solutions designed specifically for trust account management. These programs offer several advantages:

- Improved Accuracy: Automated systems reduce the risk of human error in recording and calculating transactions.

- Real-Time Tracking: Software provides ongoing insight into account balances and transaction history, enhancing transparency and accountability.

- Simplified Reporting: Trust account management software generates comprehensive reports that meet regulatory requirements, streamlining the auditing process.

- Enhanced Security: Secure online platforms minimize the risk of data loss or unauthorized access, safeguarding sensitive financial information.

Beyond the Journal: Understanding the Bigger Picture

While trust account journal entries provide a detailed accounting of client funds, it’s essential to recognize their role within a larger framework of ethical and regulatory obligations. Lawyers are required to adhere to specific trust account regulations, which may vary from jurisdiction to jurisdiction. These regulations encompass various aspects such as:

- Opening and Maintaining Trust Accounts: Lawyers are subject to requirements related to opening and maintaining separate trust accounts.

- Record-Keeping Practices: Strict record-keeping standards ensure the accuracy and clarity of trust account transactions.

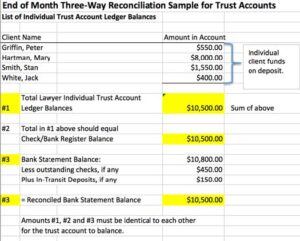

- Reconciliation and Reporting: Regular reconciliation of trust account balances and preparation of financial reports are vital for maintaining transparency and compliance.

- Prompt Disbursements: Timely disbursement of client funds is a cornerstone of ethical legal practice.

- Accountability and Oversight: Lawyer trust accounts are subject to audits and scrutiny by regulatory bodies and professional organizations.

Looking Ahead: Trust Account Management in the Modern Legal Landscape

The legal landscape is continually evolving, and trust account management is no exception. The ongoing rise of technology and the increasing complexity of legal practice will likely drive further advancements in trust accounting practices. We can expect to see further integration of artificial intelligence, blockchain technology, and other innovations to enhance accuracy, security, and efficiency in handling client funds.

Trust Account Journal Entries

Conclusion: Trust Account Entries – A Foundation of Integrity

Trust account journal entries are the backbone of responsible legal practice, reflecting the fundamental commitment to client integrity and financial transparency. Through meticulous record-keeping, accurate reporting, and strict compliance with regulatory guidelines, lawyers play a critical role in ensuring the safekeeping and proper disbursement of client funds. Understanding the intricacies of trust accounts and their management practices is an essential pillar for every legal professional, safeguarding the trust that lies at the heart of the legal profession. Are you ready to become a champion of ethical legal practice? Begin by mastering the art of trust account journal entries and experience the peace of mind that comes with knowing you are handling client assets ethically and responsibly.