Imagine you’re running a bustling bakery, your ovens humming, and the aroma of freshly baked bread filling the air. Customers are lined up, eager to get their hands on your delicious creations. But beneath the surface of this sweet success lies a complex web of financial transactions: purchases, sales, payments, and more. Keeping track of all this activity, ensuring accuracy, and making sound financial decisions requires a system – a system like the general journal.

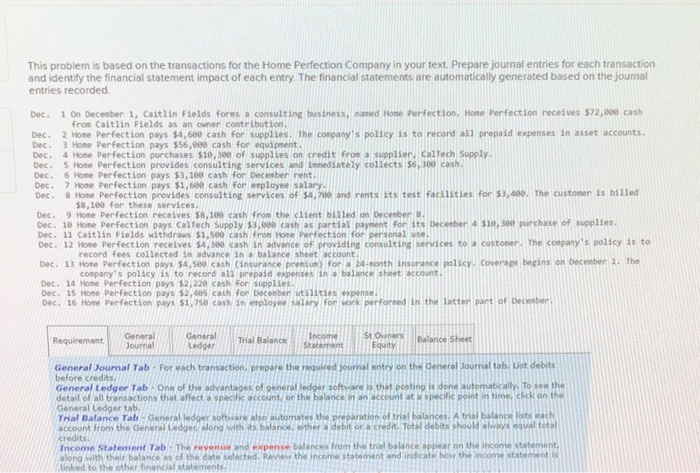

Image: www.chegg.com

For anyone trying to understand the fundamental principles of accounting, the general journal is a cornerstone. This article dives into the importance of recording general journal transactions, focusing on the classic “Problem 6.7” often encountered in introductory accounting courses. We’ll break down the process step-by-step, providing real-world examples to illuminate the concept. Whether you’re a budding entrepreneur, a student grappling with accounting concepts, or simply curious about how businesses keep their financial houses in order, this journey into the world of general journal transactions will prove enlightening.

Unveiling the Power of the General Journal

What is a General Journal?

The general journal is the fundamental record of all financial transactions within a business. Think of it as a chronological diary of financial events, meticulously documenting each transaction’s details. This includes:

- Date: When the transaction occurred.

- Account Titles: The specific accounts affected by the transaction, such as cash, accounts receivable, inventory, or expenses.

- Debit and Credit Amounts: The monetary values involved, represented by “debit” and “credit” entries that balance each other out.

- Description: A concise explanation of the transaction, providing context and clarity.

Why is it Crucial?

The general journal lays the foundation for the entire accounting system. Its meticulous records:

- Track Financial Activity: Provide a comprehensive overview of the company’s financial health, demonstrating how various transactions impact its overall performance.

- Ensure Accuracy: Maintaining a balanced and accurate general journal eliminates errors and ensures reliable financial reporting.

- Support Decision-Making: By analyzing the recorded transactions, businesses can identify trends, make informed decisions about investments, pricing, and resource allocation.

- Provide Audit Trail: The general journal serves as a transparent record that can be audited to ensure compliance with financial regulations and company policies.

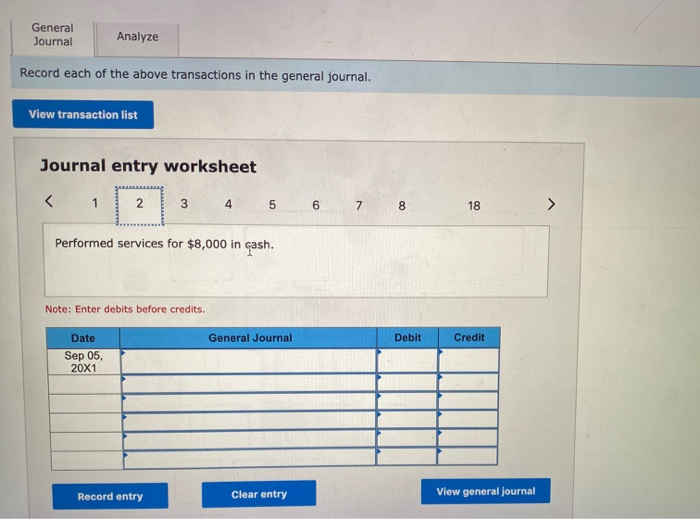

Image: www.chegg.com

Problem 6.7: A Case Study

Problem 6.7, often featured in accounting textbooks, presents a scenario where a business engages in various transactions. The challenge lies in accurately recording these transactions in the general journal, understanding the underlying debit-credit relationships involved.

The Scenario

Let’s imagine a hypothetical bakery called “Sweet Delights.” Problem 6.7 might present a series of transactions like these:

- Sweet Delights purchases flour and sugar on credit from a supplier. This involves accounts payable (a liability) and inventory (an asset).

- A customer pays cash for a dozen freshly baked cookies. This affects cash (an asset) and sales revenue (an income).

- Sweet Delights pays its rent for the month. This involves cash (an asset) and rent expense (an expense).

Breaking Down the Entries

For each transaction, we need to identify the accounts affected and determine whether they should be debited or credited. Here’s a breakdown of the fundamental accounting rules:

- Debit: Increases assets, decreases liabilities and equity. Think of debit as the “left side” of the accounting equation.

- Credit: Increases liabilities and equity, decreases assets. Credit is the “right side” of the accounting equation.

By applying these rules, we can confidently record the transactions in the general journal.

Example Journal Entries (Problem 6.7)

Let’s look at how to record a few of the “Sweet Delights” transactions in a general journal. We’ll use a simplified format for illustration.

Transaction 1: Purchase of Flour and Sugar on Credit

Date: 2023-10-27 Account Title: Inventory Debit: $500 Account Title: Accounts Payable Credit: $500 Description: Purchase of flour and sugar on credit.

Explanation:

- Inventory increases, so it’s debited.

- Accounts Payable increases, so it’s credited.

Transaction 2: Cash Sale of Cookies

Date: 2023-10-28 Account Title: Cash Debit: $25 Account Title: Sales Revenue Credit: $25 Description: Cash sale of cookies.

Explanation:

- Cash increases, so it’s debited.

- Sales Revenue increases, so it’s credited.

Transaction 3: Payment of Rent

Date: 2023-10-29 Account Title: Rent Expense Debit: $1,000 Account Title: Cash Credit: $1,000 Description: Payment of rent for the month.

Explanation:

- Rent Expense increases, so it’s debited.

- Cash decreases, so it’s credited.

Importance of Accuracy and Documentation

Recording these transactions accurately and meticulously is key to ensuring the integrity of your financial records. Every transaction, no matter how small, has the potential to impact the overall picture of your business’s financial health. It’s crucial to:

- Double-Check Entries: Ensure that every debit has a corresponding credit, maintaining the accounting equation’s balance.

- Maintain Clear Documentation: Keep detailed descriptions for each transaction, providing context and making it easier to understand the financial activity.

- Use Consistent Format: Maintain standard formatting for general journal entries to ensure clarity and consistency across all financial records.

Beyond Problem 6.7: General Journal Applications

While Problem 6.7 provides a foundational understanding of general journal transactions, it merely scratches the surface of its wide-ranging applications. In the real world, businesses utilize the general journal to record a multitude of transactions, including:

- Sales and Purchases: Tracking all sales activities and inventory purchases.

- Receivables and Payables: Managing customer payments and supplier invoices.

- Payroll and Expenses: Recording employee salaries, utility bills, and other operational expenses.

- Capital Transactions: Documenting investments, asset acquisitions, and debt financing.

- Adjusting Entries: Making necessary corrections and adjustments at the end of accounting periods to ensure accurate financial reporting.

Problem 6 7 Recording General Journal Transactions

Conclusion

Understanding general journal transactions, like those explored in Problem 6.7, is fundamental for anyone involved in financial management. The general journal serves as the bedrock for a robust accounting system, ensuring accuracy, providing a comprehensive financial overview, and supporting sound business decisions. By diligently recording every transaction, businesses gain the necessary insight to navigate the complexities of financial operations, fostering growth and success. This article has aimed to illuminate the importance of the general journal, empowering you to understand and record transactions with confidence. Now, let’s turn those “Sweet Delights” profits into a delectable success story!