Have you ever wondered how businesses keep track of their financial transactions and ensure their books are accurate? The answer lies in a process that involves meticulously recording every business activity in a journal and then summarizing that data in a trial balance. This seemingly simple system is the foundation of financial accounting, providing a crucial overview of a company’s financial health.

Image: www.chegg.com

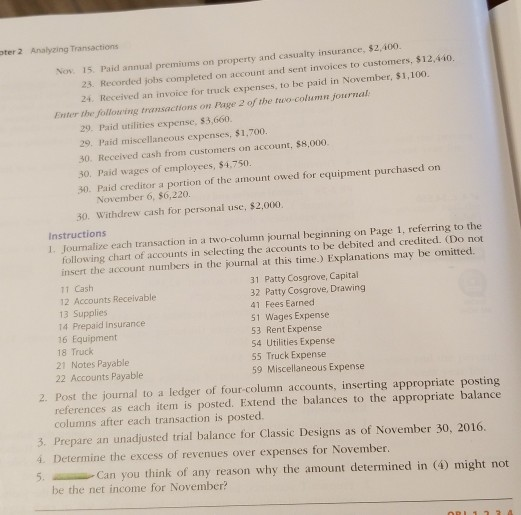

This article delves into the world of PR 2-3A, specifically focusing on the vital roles of journal entries and the trial balance. We’ll explore the principles behind these concepts, understand how they work in practice, and showcase their significance in financial reporting.

Understanding the Basics: Journal Entries and the Trial Balance

Financial transactions are the lifeblood of any business, and every transaction must be carefully documented. This is where journal entries come into play. A journal entry is essentially a record of a transaction, capturing its key details, such as the date, the accounts involved, and the amount. Each entry typically involves at least two accounts, one that is debited and another that is credited.

Think of a journal entry as a detailed receipt for a business transaction. It’s where you first record the financial impact of a transaction, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. For example, if a company purchases supplies on credit, the journal entry would show a debit to “Supplies” and a credit to “Accounts Payable,” reflecting the increase in supplies and the company’s debt obligation, respectively.

The trial balance, on the other hand, is a summary of all the accounts and their balances at a specific point in time. It is essentially a snapshot of the company’s financial position, providing a consolidated view of all debits and credits. The trial balance helps to ensure the accuracy of the accounting equation, verifying that the total debits equal the total credits.

The Importance of Journal Entries and the Trial Balance

Journal entries and the trial balance are crucial for several reasons:

- Accurate Financial Reporting: They provide the foundation for generating accurate financial statements, such as the income statement and balance sheet, which are essential for decision-making by management, investors, and creditors.

- Internal Control: They serve as a critical component of a company’s internal control system, helping to prevent errors and fraud.

- Compliance: Businesses are required to follow specific accounting standards, and journal entries and the trial balance play a crucial role in ensuring compliance with those standards.

- Financial Analysis: These records provide valuable data for financial analysis, enabling businesses to track trends, identify areas for improvement, and make informed strategic decisions.

The Mechanics of Journal Entries

Let’s break down the structure of a journal entry. A typical journal entry includes:

- Date: The date of the transaction.

- Account Titles: The names of the accounts involved in the transaction.

- Debit or Credit: Indication of whether the account has been debited or credited. Debit entries increase asset, expense, and dividend accounts while decreasing liability, equity, and revenue accounts. Credit entries increase liability, equity, and revenue accounts while decreasing asset, expense, and dividend accounts.

- Amount: The numerical value of the transaction.

In addition to the basic structure, journal entries often include a brief description of the transaction to provide context and clarity. For example, a journal entry for the purchase of office supplies on credit might look like this:

| Date | Account Titles | Debit | Credit | Description |

|---|---|---|---|---|

| 2023-10-27 | Supplies | $500 | Purchase of office supplies on credit | |

| Accounts Payable | $500 |

As you can see, the journal entry clearly records the date, the accounts involved, the debit and credit amounts, and a brief description of the transaction. This information allows for easy tracking and analysis of the financial impact of the purchase.

Image: accountingqa.blogspot.com

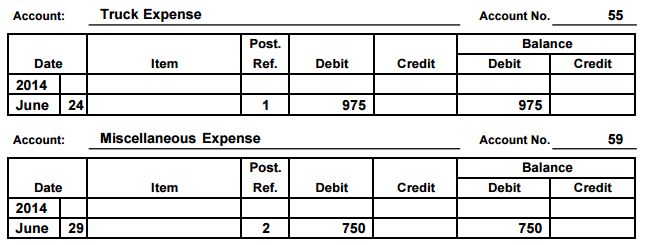

Building the Trial Balance

Once all the journal entries are recorded, they are summarized into the trial balance. This document lists all the accounts and their balances, with debits in one column and credits in another. The purpose of the trial balance is to ensure that the total debits equal the total credits, verifying the accuracy of the accounting equation.

A trial balance might look something like this:

| Account Titles | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Accounts Receivable | $5,000 | |

| Supplies | $500 | |

| Equipment | $15,000 | |

| Accounts Payable | $2,000 | |

| Common Stock | $20,000 | |

| Retained Earnings | $8,500 | |

| Sales Revenue | $12,000 | |

| Cost of Goods Sold | $6,000 | |

| Operating Expenses | $1,000 | |

As you can see, the trial balance lists all the accounts and their balances, with debits in the left column and credits in the right column. The total debits and credits must match for the trial balance to be considered balanced.

Real-World Applications of Journal Entries and Trial Balance

Journal entries and trial balances are fundamental tools in various financial applications, including:

- Financial Reporting: As mentioned earlier, these records are vital for preparing accurate financial statements, which provide a clear picture of a company’s financial performance and position.

- Internal Audits: Internal auditors use journal entries and trial balances to identify potential errors and irregularities in a company’s financial records.

- Tax Preparation: Accurate journal entries and trial balances are essential for preparing accurate tax returns.

- Financial Analysis: Analysts use journal entries and the trial balance to analyze a company’s financial performance, identify trends, and make investment decisions.

- Management Decision-Making: Management uses journal entries and trial balances to track progress, identify areas of concern, and make strategic decisions.

The Evolution of Journal Entries and Trial Balance

The concepts of journal entries and trial balances have evolved alongside the development of computer technology. Initially, these tasks were performed manually using ledgers and paper records. However, with the advent of accounting software, the process has become significantly streamlined and automated. Modern accounting software automatically generates journal entries for various transactions, eliminating the need for manual input. The trial balance is also automatically generated, providing an instant snapshot of a company’s financial position.

Addressing Common Challenges

While journal entries and the trial balance are essential tools in accounting, they can present challenges. Here are some common challenges:

- Mistakes: Human error can lead to mistakes in journal entries, which can impact the accuracy of the trial balance. Mistakes can occur due to incorrect account selection, incorrect amounts, or missing entries.

- Complexity: As businesses grow and become more complex, the number of transactions increases, leading to more intricate journal entries and trial balances.

- Fraud: Journal entries can be manipulated to hide fraudulent activities. It is crucial to have strong internal controls and regular audits to mitigate this risk.

To overcome these challenges, businesses can implement best practices, such as:

- Use accurate information: Ensure all data is accurate and complete to avoid errors in journal entries.

- Maintain consistent data: Ensure data consistency across different systems and databases.

- Implement strong internal controls: Establish robust internal controls to prevent fraud and ensure the accuracy of financial information. These controls include separation of duties, independent verification, and regular audits.

- Use accounting software: Utilize accounting software to automate journal entries and trial balances, minimizing errors and increasing efficiency.

Pr 2-3a Journal Entries And Trial Balance

Conclusion

Journal entries and the trial balance are critical components of financial accounting, providing a foundation for accurate financial reporting, internal control, and informed decision-making. Understanding these basic concepts is essential for anyone involved in business operations, whether you are a manager, accountant, or investor. By utilizing best practices and technology, businesses can embrace these powerful tools to maintain financial accuracy, mitigate risks, and make sound decisions.

To further enhance your knowledge, consider exploring advanced accounting resources, attending workshops, or connecting with accounting professionals. This journey into the fascinating world of financial recordkeeping is just beginning, and there’s always more to discover. Happy accounting!