Imagine this: you’re relaxing at home, enjoying a warm cup of coffee, when suddenly, a pipe bursts, flooding your kitchen and leaving your beautiful hardwood floors soaked and warped. You’re devastated, wondering how you’ll ever afford to replace them. But then, you remember – you have homeowners insurance. Will it help cover the cost? The answer isn’t always straightforward, as homeowners insurance policies can be complex and vary depending on the specific coverage details.

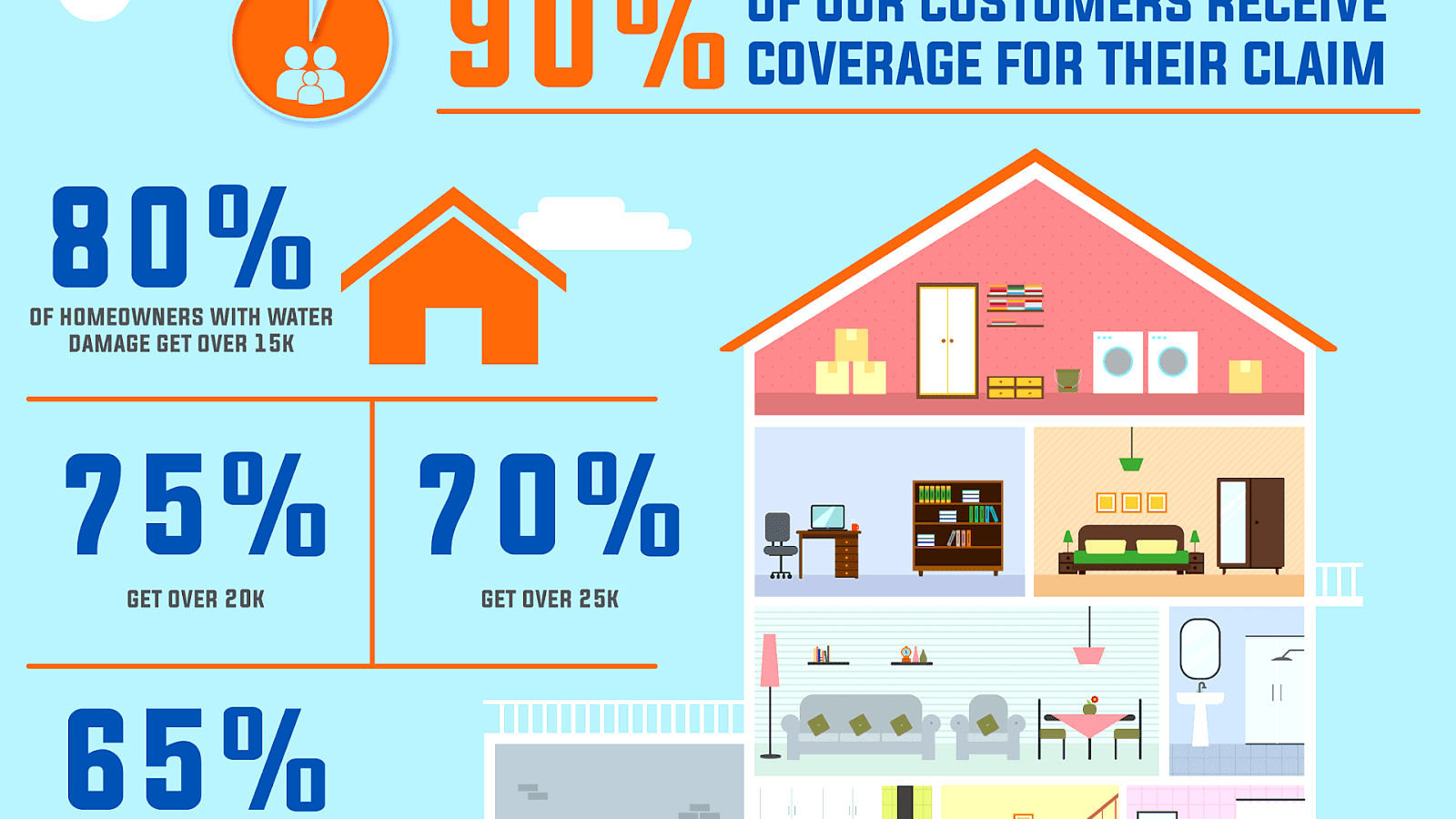

Image: www.einsurance.com

Understanding what your homeowners insurance covers and how it works is essential, especially when it comes to expensive damage like hardwood floor replacement. This article will delve into the intricacies of homeowners insurance, addressing the question: does homeowners insurance cover hardwood floor damage? We’ll explore the different types of coverage, common exclusions, and practical advice on navigating the claims process. By the end, you’ll have a better grasp of navigating the world of homeowners insurance regarding hardwood floor damage.

The Essentials of Homeowners Insurance

Homeowners insurance is designed to protect your home and belongings against various risks, providing financial compensation for covered losses. These policies typically cover damage caused by:

- Fire: This covers damage from a fire, including smoke and water used to extinguish it.

- Windstorm: Includes damage from wind, hail, and tornadoes.

- Lightning: Covers damage caused by lightning strikes.

- Theft: Protects against loss or damage due to theft.

- Vandalism: Covers damage caused by deliberate acts of vandalism.

- Some Water Damage: This typically includes damage from plumbing issues, but may exclude flood damage.

The extent of coverage depends on the type of homeowners insurance policy you have. There are several types, each with its own strengths and weaknesses:

- HO-3 (Special Form): The most common type, providing coverage for all perils except those specifically excluded in the policy.

- HO-5 (Comprehensive Form): Offers the broadest coverage, insuring against all perils, including those not explicitly mentioned.

- HO-8 (Modified Coverage Form): Designed for older homes, covering damage from fewer perils and usually using an actual cash value (ACV) instead of replacement cost.

- HO-4 (Contents Broad Form): A renters insurance policy, designed for those who rent their home, covering personal property and liability.

Hardwood Floor Damage: A Complex Landscape

When it comes to hardwood floor damage, the coverage landscape becomes more complex. While some damage might be covered, other situations could lead to a denial of your claim. Here are some common scenarios:

Covered Damage:

- Fire Damage: If your hardwood floors are damaged by a fire that falls under your policy’s covered perils, your insurance should help with the cost of repair or replacement.

- Windstorm Damage: Damage caused by a windstorm, such as a tree falling on your roof and damaging the floors below, is likely covered.

- Water Damage (from Plumbing Issues): In most cases, damage caused by a burst pipe or other plumbing issues is covered by standard homeowners insurance.

- Vandalism: If your hardwood floors are damaged due to intentional acts of vandalism, your insurance should compensate for the repairs or replacements.

- Theft: While less common with floors themselves, if thieves damage your floors during a burglary, such as breaking through the floorboards to enter your house, it could be covered.

Image: thedamagechoices.blogspot.com

Excluded Damage:

It’s important to recognize situations where your homeowner’s insurance might not cover hardwood floor damage, such as:

- Normal Wear and Tear: Your homeowners insurance typically doesn’t cover damage due to natural wear and tear. This means scratches, dents, or fading over time are usually not covered by insurance.

- Neglect: Damage resulting from prolonged neglect, such as allowing water to seep under the floorboards for a long time, might not be covered.

- Flood Damage: Standard homeowners insurance doesn’t include flood damage. You’ll need a separate flood insurance policy for this type of coverage.

- Earthquake Damage: While some homeowners insurance policies might offer earthquake coverage, it’s usually an optional add-on, requiring an additional premium.

- Improper Installation: If the damage resulted from faulty installation or improper maintenance, the claim might be denied.

Navigating the Claims Process

If you experience damage to your hardwood floors, you’ll need to file a claim with your insurance company. To ensure a smooth process, keep these tips in mind:

- Contact your insurance company immediately: Don’t delay reporting the damage; the sooner you contact them, the better.

- Document the damage: Take photographs and videos of the damaged area from various angles.

- Keep receipts: If you make temporary repairs or purchase materials to protect your home, keep the receipts.

- Be honest and detailed: Provide complete and accurate information about the incident and the extent of the damage. This will help your claim move forward smoothly.

- Be patient: The claims process can take time, so be patient and work closely with your insurance agent.

- Review your policy carefully: Understand the details of your policy before filing a claim. This ensures you know what’s covered and what isn’t.

Factors Affecting Coverage

Beyond the type of damage, other factors can affect your chances of receiving compensation for hardwood floor damage. These include:

- Your policy deductible: You are responsible for paying the deductible, which is the initial amount you need to cover before your insurance kicks in. A higher deductible typically leads to lower premiums, but you’ll pay more out of pocket for covered damages.

- Your policy limits: Every insurance policy has limits on the maximum amount they will cover for specific types of damage. If the damage exceeds those limits, you’ll be responsible for the difference.

- Your insurance company’s claims process: Different insurance companies have varying claims processes. Some might be faster and more efficient than others.

- Your home’s age and condition: The age and overall condition of your home can influence the insurance company’s assessment of the damage and the potential payout.

Finding the Right Coverage

Knowing what your homeowners insurance covers is crucial when protecting your investment in your home. Here are some tips for ensuring you have adequate coverage for your hardwood floors and other possessions:

- Review your policy regularly: Don’t just assume your coverage is adequate; revisit it at least annually to ensure it meets your current needs.

- Consider additional coverage: Depending on your home’s value and the risks you face, consider additional coverage options like flood insurance or earthquake coverage. This can ensure you’re protected against a broader range of disasters.

- Consult with an insurance broker: An experienced broker can help you understand your coverage options and tailor a policy that meets your specific needs.

- Shop around for quotes: Comparing quotes from different insurance companies can help you find the best coverage at the most competitive price.

Does Homeowners Insurance Cover Hardwood Floor Damage

Conclusion

Whether homeowners insurance covers hardwood floor damage depends on the cause of the damage, your policy type, and several other factors. Understanding the details of your policy and your coverage limits is essential. Be sure to document any damage thoroughly, file claims promptly, and work closely with your insurance company through the process. Remember, having adequate homeowners insurance is crucial to protecting your home and belongings against various risks. By taking the time to understand your coverage and proactively addressing your insurance needs, you can gain peace of mind and be better prepared to handle unexpected events.